Irs Electric Vehicle Incentives

BlogIrs Electric Vehicle Incentives - Electric Vehicles Qualify For Tax Credit Electric Vehicle Latest News, It should be easier to get because it's now available as an instant rebate at. The federal ev charger tax credit for electric vehicle charging stations and equipment is back with a few key changes. Clean vehicle credit under irc 30d (sole proprietorships and other business entities):

Electric Vehicles Qualify For Tax Credit Electric Vehicle Latest News, It should be easier to get because it's now available as an instant rebate at. The federal ev charger tax credit for electric vehicle charging stations and equipment is back with a few key changes.

How Do the Used and Commercial Clean Vehicle Tax Credits Work? Blink, Until now, the irs allowed taxpayers to. Starting in january, you’ll be able to get an electric vehicle tax credit of up to $7,500 without having to wait for the irs to.

These Countries Offer The Best Electric Car Incentives to Boost Sales, You may qualify for a credit up to $7,500 for buying a qualified new car or light truck. the credit is available to individuals and businesses. California’s clean air vehicle program, for example, grants carpool lane access to select electric vehicles.

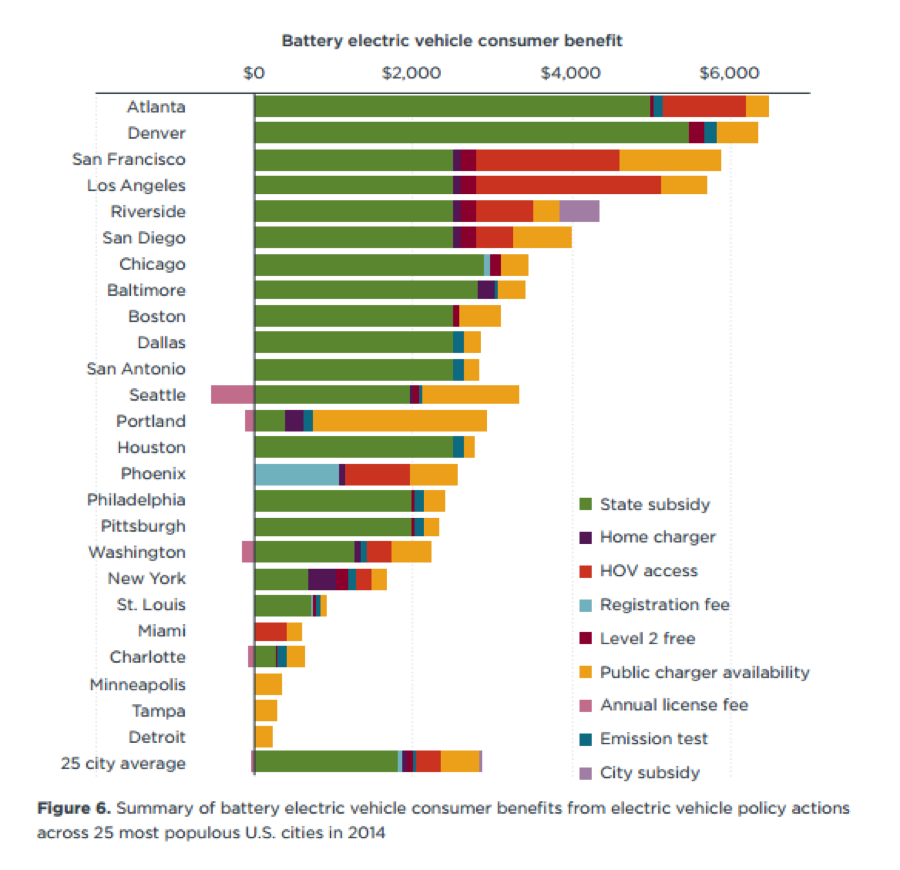

Which Incentives Are Driving Electric Vehicle Adoption?, It should be easier to get because it's now available as an instant rebate at. For use primarily in the u.s.

Understanding Electric Vehicles Federal Tax Credits EV & PlugIn, You can get a $7,500 tax credit, but it won't be easy. Today’s guidance marks a first step in the biden administration’s implementation of inflation reduction act tax credits to lower costs for families and make.

What’s up with federal and state incentives for electric cars?, To qualify, you must buy the vehicle: Starting in january, you’ll be able to get an electric vehicle tax credit of up to $7,500 without having to wait for the irs to.

Clean vehicle credit under irc 30d (sole proprietorships and other business entities): The federal ev charger tax credit for electric vehicle charging stations and equipment is back with a few key changes.

What Are California's Electric Car Incentives? 2025 Updates, For use primarily in the u.s. You may qualify for a credit up to $7,500 for buying a qualified new car or light truck. the credit is available to individuals and businesses.

US cities offer diverse incentives for electric vehicles — Center for, A $7,500 tax credit for electric vehicles has seen substantial changes in 2025. This is possible if the dealership is one of the over ten thousand that has registered with the irs to participate in the electric vehicle credit program.

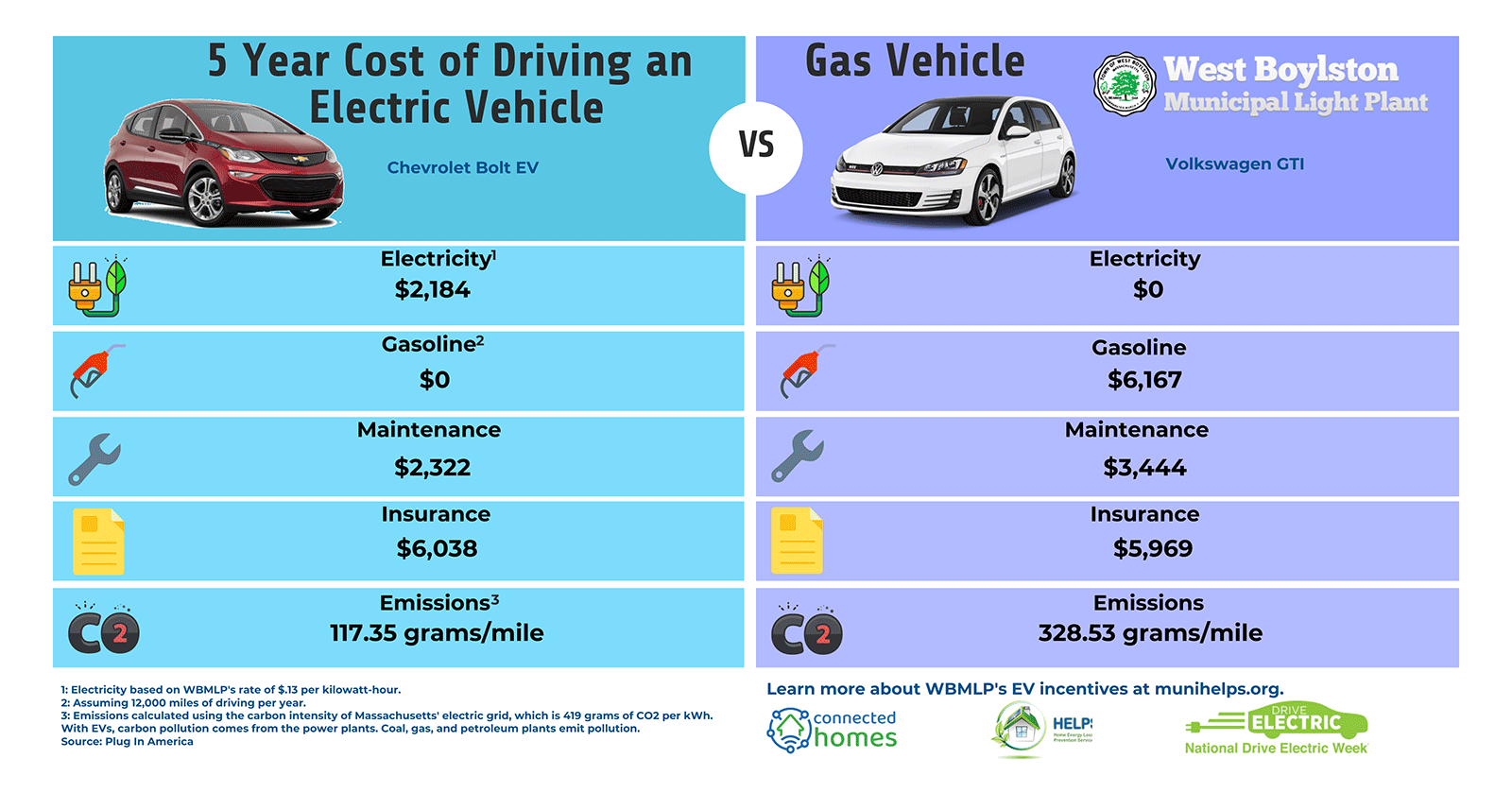

Reasons Why Electric Cars Are Better Than Gas Cars CLUB IRA, Department of the treasury and internal revenue service (irs) released additional guidance under president biden’s inflation. California’s clean air vehicle program, for example, grants carpool lane access to select electric vehicles.

Electric Vehicle (EV) Incentives & Rebates, Starting in january, you’ll be able to get an electric vehicle tax credit of up to $7,500 without having to wait for the irs to. Two credits are available for vehicles purchased or leased for business use.